Ease requirements to start a business and reduce costs

With record unemployment, many Americans are looking to go into business for themselves, creating new jobs and unique products or services to meet the needs of their communities.

But too often, would-be business owners must navigate a maze of rules and requirements that make getting up and running a months- or even years-long process. From corporate and tax registration to business licenses and complex permits, governments require entrepreneurs to pay hundreds—or even thousands—in start-up fees. Meanwhile, paperwork and in-person visits to agencies pile up. And by opening day, applicants have often spent more resources on compliance than on getting their storefronts or websites ready for customers.

While most rules for starting a business exist at the local level, state officials can easily look to reduce red tape from state agencies that gets in the way of entrepreneurs looking to earn an honest living in times of crisis.

Through years of research on rules for starting a business, the Institute for Justice has identified the following areas of reform at the state level. State officials should:

- Cut fees for permits, licenses, and registrations.

- Streamline requirements that aren’t necessary for protecting health and safety.

- Move paperwork and resources online to improve public health while making it quicker and easier to complete regulatory requirements from home.

Cut Fees

Adding on to high fees for occupational licenses are steep costs for completing other necessary steps to open a business. Many business types, such as restaurants and barber shops, are required to get permits from state agencies that cost several hundred dollars. That’s not to mention fees for registering as a corporation—another several hundred dollars—or for filing other types of paperwork.

States should explore ways to reduce fees that place financial burdens on lower- or middle-income entrepreneurs.

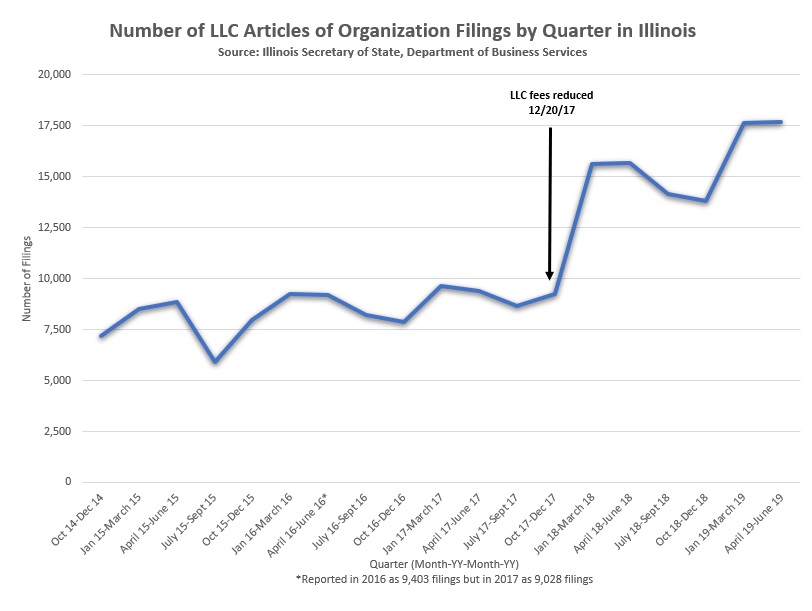

For example, in 2017, Illinois cut corporate registration fees for LLCs from $500 to $150, which paved the way for a 62% increase in registrations the following quarter (see below).

Streamline Requirements

Officials can also work to streamline regulations for business types that have to register with state departments, like retail businesses that need sales tax permits or food entrepreneurs who must pass through a weeks- or months-long process for getting their approvals from the health department.

Move Paperwork and Resources Online

Finally, states should make sure that the process for starting up is simple and clear. Officials should create online checklists that educate would-be business owners on regulatory requirements, step-by-step. They should also adopt one-stop shops that allow entrepreneurs to submit applications online and handle their obligations to the state in one convenient location or portal.

To protect public health and safety, Michigan’s Barbering Board now facilitates all applications for licensure through its online portal. And some jurisdictions, like Orange County, Fla., have explored ways to conduct inspections remotely to prevent backlogs.

Get Started Today.

Please fill out this form and an IJ staff member will reach out to you shortly.